What did ancient Chinese money look like? When did inflation first occur? Why are banknotes burned every year and what is “Hell Bank”? 10 facts you probably did not know about Chinese money:

- What does Chinese money look like? The first bronze pieces that were used in China as currency, around the 7th-6th centuries BC, were spade-shaped coins.

A spade-shaped coin from the 6th century BC

2. The first round coin appeared during the 5-4th century BC. The coinage in China then underwent a transition in means of payment, and a new shape of coins was cast in the form of a round disc with a hole in the center. The holed disc remained the basic shape of Chinese coins until the 20th century.

A Chinese coin from the 5th century BC

A Chinese coin from the 5th century BC

3. Originally, in ancient Chinese money, the coin’s value was equal to its weight. However, from the 2nd century BC, the actual content of the coin was reduced, and the central hole was enlarged. From then on, a difference between the face value and the actual value of the metal became common.

4. The first occurrence of inflation in China was in the 2nd century BC, due to the massive recruitment of workers building the Great Wall, and a series of wars.

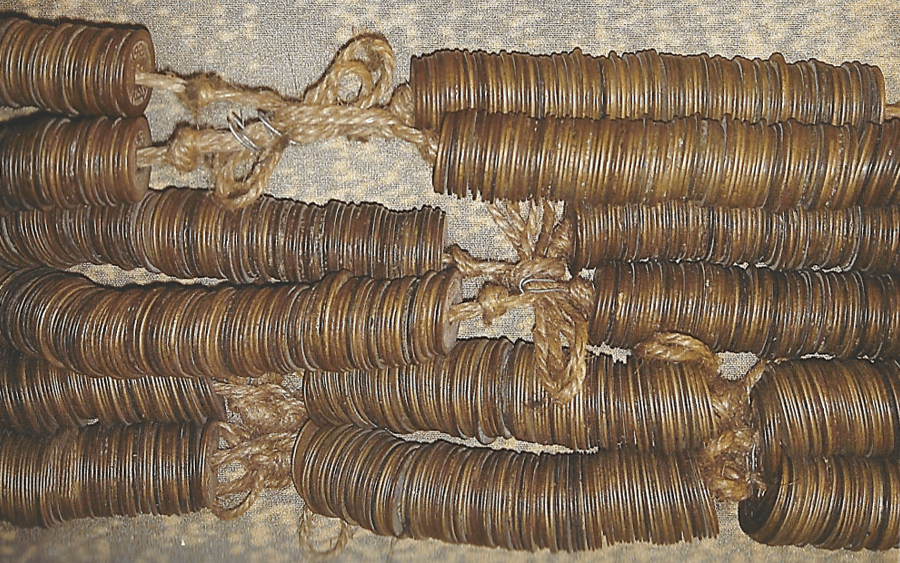

5. Due to the low value of a single coin, it was customary to form a string of 1000 coins into a purchasing unit.

6. The ancient Chinese money was a means of exchange and a measure of value alone. In other words, the purpose of the Chinese currency was not to store value, hence why it remained low in value for centuries. The Chinese believed that currency had to circulate in the social structure as blood flows in the human body.

7. The evolution of Chinese money: The first time paper money was used was in China in the 9th century.

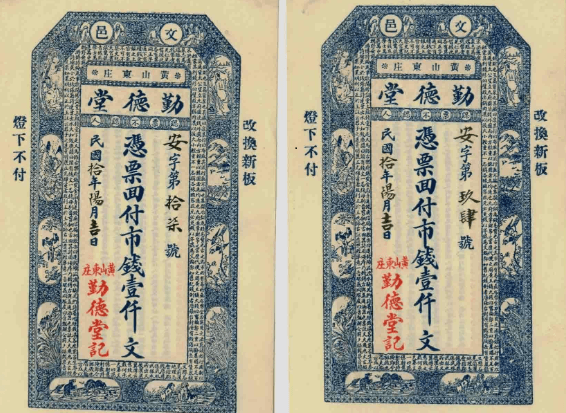

Chinese paper money from the 9th century

Chinese paper money from the 9th century

8. When Marco Polo arrived in China in the 13th century, he was impressed by the use of paper-formed Chinese money. He described this amazing innovation in his journey records: “All these pieces of paper are issued with as much solemnity and authority as if they were of pure gold or silver”. When he returned to Italy, people did not believe his stories about the paper money in China. The West started printing banknotes centuries later.

9. The Chinese invented a method to detect forgeries. They hid secret marks on the bills and enforced strict regulations. Forgers were punished by the death penalty, while the informer received a reward in addition to the criminal’s property.

10. In Chinese tradition, it is customary to make offerings in honor of one’s ancestors. One of these offerings is burning “Hell Banknotes”, a tribute to the King of Hell that is meant to ensure that the spirits are treated well in the afterlife. Since the 19th century, millions of these paper notes have been burnt every year in celebration of the Chinese New Year festival.

Managing the financials of your operation in China with maximum efficiency and transparency is not a luxury. It’s an absolute must in order to do business in China.

Managing the financials of your operation in China with maximum efficiency and transparency is not a luxury. It’s an absolute must in order to do business in China.

Learn more about Financial services in China, Budget Planning & Control, and Tax Incentives in China, or Get in touch for more information and practical solutions.